When you purchase life cover, you're not just acquiring a financial safety net; you're investing in the future of your loved ones. Life is full of unexpected turns, and having a reliable security blanket can offer immeasurable peace of mind knowing that your family will be taken care of in the event of the unforeseen.

- Think about the impact life cover can have on your family's stability.

- Imagine a future where your loved ones are ensured against financial strain.

- Securing life cover is a thoughtful step towards building a more secure future for everyone who looks to you.

Protecting Your Future

Life is full of unforeseen challenges, and protecting what matters most should be a priority. Cover life insurance provides a financial safety net for your dependents in the sad chance of your passing. This comprehensive coverage can help ensure their well-being, allowing them to navigate life's challenges without excessive difficulty.

- With cover life insurance, you can ensure financial security' futures.

- Adjust your coverage to suit your specific needs and circumstances.

- Get a personalized estimate today and explore how cover life insurance can protect your loved ones' financial future.

Exploring The Ultimate Guide to Life Cover Options

Securing your financial future is a important aspect of responsible life planning. Life cover, also called as life insurance, provides financial protection to loved ones in the event of unforeseen events. Choosing the right life cover policy can feel daunting, but this in-depth guide will illuminate on different types of life cover available, helping you make an savvy decision.

- Limited Life Cover: Perfect for specific goals, providing financial support for a specified period.

- Universal Life Cover: Offers permanent coverage along with savings components.

- Health Cover: Provides a one-time payment if you are afflicted with a critical illness.

Understanding the details of each policy is crucial to guarantee you select the financial support that best fulfills your specific needs and circumstances.

Investing in Tomorrow with Life Cover

Life is full of challenges, and while we can't predict the future, we can prepare for it. One way to do this is through life cover. It provides a financial cushion for your loved ones if the unexpected happens. By investing in life cover today, you're ensuring their financial security tomorrow. It's not just about replacing income; it's about giving them the means to continue living comfortably.

- Evaluate different types of life cover to find the best fit for your needs and budget.

- Consult with a financial advisor to gain clarity on your options.

- Keep in mind that investing in life cover is an investment in the people you love most.

Protecting Your Loved Ones: The Power of Life Insurance

When sudden events occur, life insurance can provide a vital financial safety net for your family. That protection helps alleviate the pressure of unexpected expenses and allows your loved ones to keep their financial security. By determining a policy that satisfies your family's unique needs, you can provide them peace of mind and economic stability during tough times.

- Life insurance can cover essential expenses such as housing, tuition, and treatment.

- It can also help substitute lost income, enabling your family to prosper even in your absence.

Insurance Safety Net : A Safety Net for Surprising Events

Life is full of uncertainties, and it's impossible to predict what the future holds. However, with life cover in place, you can provide a financial buffer for your loved ones in case of your untimely demise. This type of insurance lessens the stress on your family by providing them with a amount of money to cover bills such as mortgages, schooling, and ordinary costs.

Moreover, life cover can also provide comfort knowing that your family will be taken care of even in the face of challenges. It's a thoughtful investment that can offer immense benefits to both you and your loved ones.

Understanding Life Cover: Key Factors to Consider

When it comes to securing your loved ones' economic well-being after you're gone, life cover is an vital factor. Choosing the right policy can feel challenging, but by focusing on these primary factors, you can make an intelligent selection:

- Coverage amount: Determine how much financial support your family will require to cover obligations like debt settlement, schooling and household costs.

- Policy type: Explore different alternatives such as pure protection or permanent cover, each with itsspecial features and costs.

- Insurer's reputation: Research and assess the stability of different institutions to ensure they can fulfill their commitments.

- Health conditions: Be honest about your medical history as it will affect your costs.

Remember, life cover is a personalized choice based on your individual needs. Consult with a qualified financial advisor to explore the best choices for you and your family.

Obtaining the Right Life Cover: A Step-by-Step Guide

Navigating the world of life cover can be challenging, but it's crucial to protect your loved onesfinancially. To choose the perfect policy, follow these steps: First, evaluate your financial needs and consider your loved ones. Next, compare different types of life cover, such as term life, whole life, or universal life. Obtain quotes from multiple insurance providers and thoroughly review the coverage details. Don't hesitate to reach out to a financial advisor for personalized guidance. By taking these actions, you can ensure your family with the financial security they need in times of hardship.

Covering Life's Unforeseen Journeys: The Importance of Life Insurance

Life is a tapestry woven with both joy and uncertainty. While we cherish the beautiful moments, it's crucial to acknowledge that unforeseen journeys may lie ahead. Unexpected events can arise at any time, leaving behind financial burdens and emotional distress for our loved ones. This is where life insurance steps in, providing a vital protective shield to ensure their well-being even in the face of adversity.

A life insurance policy acts as a pillar of security, offering peace of mind. It provides resources to help cover essential expenses, such as mortgage payments, education funds, and daily living costs. By mitigating the financial strain on your family, life insurance allows them to devote their time and energy to healing and rebuilding their lives.

In essence, life insurance is a testament to your commitment. It's a way to express your desire to provide for your family even after you're gone, ensuring they can navigate life's uncertainties with confidence.

Life Insurance vs. Term Life Insurance: What's the Difference?

Are you examining life insurance and feeling overwhelmed by all the choices? Two common types of coverage often cause confusion: life cover. Here we will break down the key differences between these two to help you make the best fit for your needs.

Essentially, life cover provides a comprehensive range of benefits that include both death benefits and a accumulation feature. On the other hand, term life insurance is a strictly death benefit policy that lasts for a specified period, usually between 10 and 30 years.

- Understand the Term: "Term Life Insurance" refers to coverage for a set term or period, while "Whole Life Insurance" often implies lifelong protection.

- Evaluate Your Needs: If you need temporary coverage for specific obligations like a mortgage or children's education, term life insurance is usually more economical.

- Compare Premiums: Term life insurance typically has more affordable premiums compared to whole life insurance. However, whole life policies can build cash value over time.

Exploring Martian Life: Fact or Fantasy?

For centuries, humanity has gazed at the stars, wondering about the possibility of life beyond our own planet. Now, with breakthroughs in space exploration, Mars, the red planet, has emerged as a prime candidate for harboring extraterrestrial life. Is it possible microbial organisms exist beneath the Martian surface, thriving in unforgiving conditions? Or is the search for life on Mars simply a futuristic fantasy?

The question of Martian life has captivated researchers for decades. Missions like Curiosity and Perseverance have analyzed valuable data, revealing tantalizing clues about Mars's past environment. It is conceivable that liquid water once flowed on the surface, creating conditions suitable to life as we know it.

While definitive proof of Martian life remains elusive, the evidence is increasingly suggestive. Upcoming missions aim to delve deeper into the Martian subsurface, searching for signs of ancient or extant fossils. The quest to answer this fundamental question - are we alone in the universe? - continues to drive exploration and inspire wonder.

Space Odyssey: Exploring Life Insurance for Martian Colonists

As humanity sets its sights on creating a permanent presence on Mars, the question of protection takes on a whole new dimension. Standard life insurance models, designed for Earth's landscape, may prove inadequate in the harsh Martian territory.

A unique framework of space-faring assurance is needed to counter the peculiarities of colonizing another planet. This involves assessing factors such as radiation exposure, limited medical resources, and the inherent hazards of space travel itself.

One possible solution could involve a autonomous insurance network that leverages blockchain technology to streamline transparent and secure transactions. This would allow Martian colonists to acquire coverage tailored to their specific needs and situations, guaranteeing a safety net in the face of the unknown.

Covering Life On Mars: A Journey into Extraterrestrial Risk Assessment

The quest to uncover life beyond Earth has captivated explorers for centuries. Now, with the ambitious aim of sending humans to Mars within our lifetime, understanding the potential risks posed by Martian ecosystems is paramount. This article examines the complex obstacles associated with extraterrestrial risk assessment, focusing on the distinctness of Mars and its probable inhabitants. From identifying biological threats to mitigating infection risks, we'll traverse the intricate landscape of Martian peril, shedding light on the vital steps needed to ensure a safe and successful human exploration of the Red Planet.

- Examining biological threats to mitigating contamination risks, we'll traverse the intricate landscape of Martian peril.

- Understanding the potential for life on Mars is crucial to our understanding of the universe and our place in it.

From Earth to Red Planet: The Evolution of Life Cover in Space Exploration

Space exploration has always been a daring endeavor, pushing the boundaries of human knowledge and technological prowess. As we venture further into the cosmos, the concept of life cover protection becomes increasingly vital. From the initial initiatives of launching satellites to ambitious missions like touching down on Mars, the methods employed to guarantee the safety and survival of both human astronauts and delicate scientific equipment have evolved dramatically.

Early spaceflights relied on rudimentary technologies designed to counteract the harshness of space. Safeguards from cosmic radiation was a primary priority, with materials like aluminum and lead being used to create defenses. As missions advanced, so too did the complexity of life cover approaches. The development of more sophisticated vests for astronauts provided enhanced protection against both environmental extremes and potential hazards.

- Imagine the challenges faced by spacecraft venturing to Mars. The journey is long, exposing crews to intense radiation levels and the psychological strain of isolation. To address these challenges, scientists are exploring innovative ideas, including advanced shielding materials and artificial gravity systems.

- The future of life cover in space exploration is likely to be shaped by advancements in nanotechnology, robotics, and biotechnology. Imagine self-healing spacecraft materials, autonomous robots that can repair damage, and even bioengineered organisms capable of cleaning up hazardous environments.

Finally, the evolution of life cover is a testament to human ingenuity and our unwavering desire to explore the cosmos. As we push the limits of space travel, the development of ever-more sophisticated life cover solutions will be essential to ensuring the safety and success of future missions.

Life Beyond Limits: Imagining Life Cover in the Galactic Age

As humanity spreads its reach across the cosmos, the concept of life protection takes on a revolutionary new meaning. Once|Previously|Before long, insuring against terrestrial hazards like natural disasters or medical emergencies seems almost archaic compared to the potential perils of interstellar travel and colonization.

Imagine: a policy that protects you from cosmic radiation exposure during a journey to Mars, or coverage for cybernetic augmentations gone south. The future of galactic insurance is as vast as space itself.

Covering Life of Pablo: A Look at Kanye West's Financial Influence

Kanye West, the enigma, has always pushed boundaries, both musically and financially. His ambitious ventures, from groundbreaking albums like "My Beautiful Dark Twisted Fantasy" to his innovative Yeezy brand, does life insurance cover accidents have cemented his place as a cultural powerhouse. But the question remains: just how vast is Kanye's influence?

West's wealth is a complex tapestry woven from various threads: music sales, streaming royalties, merchandise earnings, and of course, his highly profitable Yeezy collaborations with Adidas. The brand has reportedly generated billions in sales and become a cultural phenomenon, enhancing Kanye's status as a master of branding and business.

To truly understand Kanye West's financial legacy, we must delve deeper into the numbers, analyzing his investment strategies, business partnerships, and influence on global markets. This exploration will shed light on the man behind the music, revealing the meticulous architect of a financial empire built on creativity, risk-taking, and an unwavering belief in himself.

A Glimpse into Pablo's Protection: Assessing Risks for a Worldwide Luminary

Pablo, the charismatic singer, has captivated audiences worldwide. His meteoric rise to stardom has propelled him into the spotlight, demanding a comprehensive understanding of his insurance needs. From performing, which inherently carries risks, to protecting his valuable possessions, Pablo's insurance portfolio must be as dynamic as his career. A careful analysis of potential threats is crucial to ensure that Pablo's Paradise remains a protected haven for him and those who work alongside him.

- High-value personal belongings insurance

- Risk mitigation during tours

- Medical coverage and support

Delving the Music: Analyzing Kanye's Life Image Strategy

Kanye West is a polarizing figure, infamous for his musical genius and provocative persona. His life has been a constant spectacle, publicly broadcast. This raises the question: is there a strategy behind Kanye's media manipulation? Dissecting his public appearances, statements, and projects reveals a fascinating tapestry woven to subvert expectations.

- His music often commentates on themes of fame, identity, and social commentary.

- He frequently challenges the media with outlandish statements and actions.

- His collaborations with influential figures in fashion, art, and entertainment generate a broader image of creative genius.

Consistently, Kanye's life cover strategy is a complex and evolving construct. Despite intentional or not, it has cemented his status as one of the most controversial figures in modern culture.

Safeguarding the Yeezy Legacy: Life Insurance for Artistic Impact

When visionary artist Kanye West built/crafted/forged his iconic brand/empire/platform known as Yeezy, he wasn't just creating/designing/producing footwear and apparel; he was shaping/influencing/transforming culture itself. The Yeezy brand has become a global phenomenon, symbolizing innovation/creativity/individuality. However, like any valuable artistic legacy, it requires protection/safeguarding/preservation to ensure its longevity and impact beyond West's lifetime. This is where life insurance steps in/comes into play/plays a crucial role.

Life insurance policies can be structured/tailored/designed to reflect/mirror/accommodate the unique needs of an artistic estate like Yeezy. A well-crafted policy can provide financial/monetary/capital resources to sustain/maintain/support the brand's operations, fund future creative endeavors, and ensure that West's vision/artistic direction/legacy continues to be realized.

- Furthermore/Moreover/Additionally, life insurance can help mitigate/minimize/reduce potential conflicts among stakeholders after an individual's passing by providing a clear framework/structure/pathway for the distribution of assets and intellectual property rights.

- Ultimately/In essence/At its core, life insurance acts as a powerful tool for preserving and nurturing artistic legacies like Yeezy, allowing them to thrive/flourish/perpetuate beyond their creator's physical presence.

Covering a Living Legend: The Complexities of Guaranteeing Kanye West

Kanye West is more than just a musician; he's a global icon, an influential artist, and, let's be frank, a bit of a wild card. Insuring someone with his level of fame and notoriety presents a unique set of challenges for insurance companies. His work often push boundaries, sometimes leading to unpredictable outcomes. From polarizing statements to public feuds, West's actions can spark public scrutiny and potentially lead to unforeseen liabilities.

Underwriters must carefully analyze his past behavior, current projects, and even his social media presence to assess the level of risk involved. One wrong move could have serious consequences for both West and his providers. It's a tightrope walk between providing adequate coverage and avoiding exorbitant premiums that might restrict his creative freedom.

- Ultimately, insuring Kanye West is about finding a balance between protecting him from financial ruin and acknowledging the inherent volatility of his public persona.

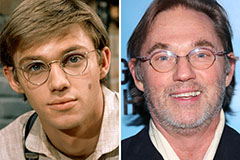

Josh Saviano Then & Now!

Josh Saviano Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!